America’s car dealers have been on a roller coaster ride since early in the COVID-19 pandemic. For a while, they had too few cars and sold most vehicles at or above their list price. Then, many overcorrected and had so many that they needed to mark cars down to move them.

As 2024 ends, a few are still undersupplied. But more are at the other end of the scale. For shoppers, paying attention to the difference could save thousands.

How Dealers Count Cars

Car dealers track their supply of cars for sale in a metric they call days of inventory. It measures how long it would take them to sell out at today’s sales pace if they couldn’t acquire more.

Each dealership has its own internal target based on how its community shops. But, roughly speaking, an old industry guideline tells them to aim for 60 days’ worth of cars on the lot and 15 more on order or in transit — a total of 75.

Ford, Buick, Jeep, and Others Making Deals

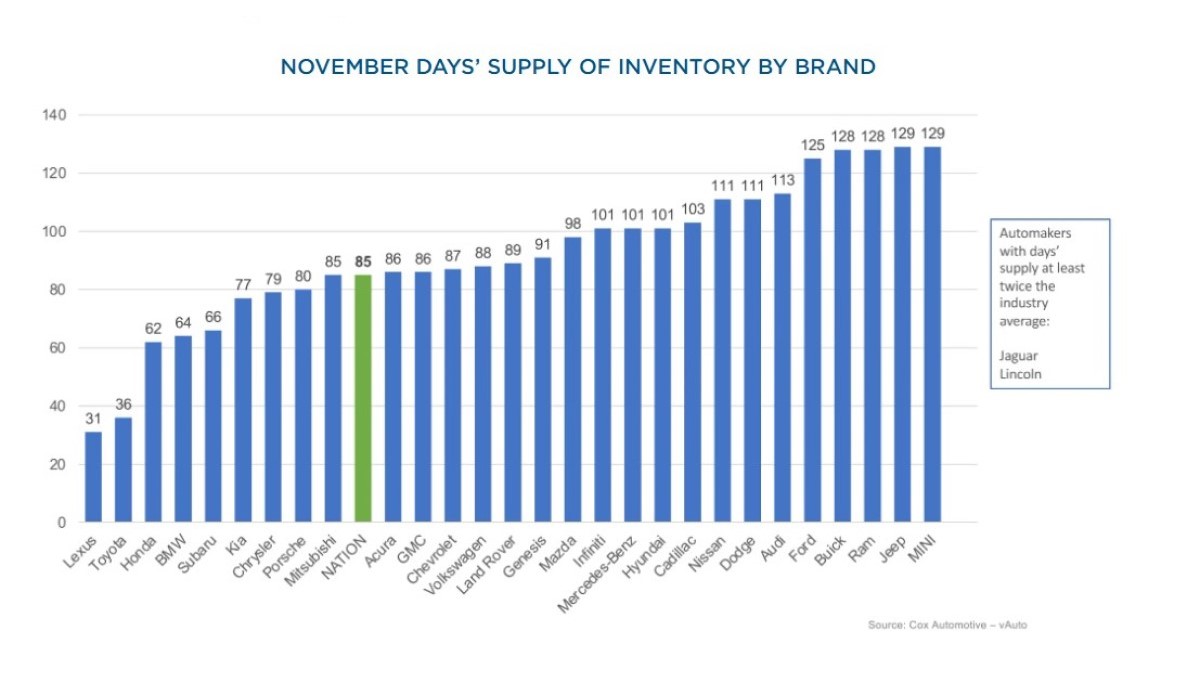

Currently, the average brand has 85. The most overstocked brands have more than 170. The least has just 31.

The data come from vAuto, a company that provides dealership management software. Kelley Blue Book and vAuto share an owner — Cox Automotive.

The chart above is important for shoppers to understand. If you’re interested in a Lexus (31 days) or a Toyota (36), dealers don’t have to offer a heavy discount to sell cars. They have so few that they can be reasonably sure a buyer will come along soon interested in what they have.

That’s not true at Ford (125 days), Buick (128), or Jeep (129). Dealers selling Lincoln are in a particularly bad situation, with more than 170.

Jaguar also appears as an outlier, but that number is unusual. Jaguar is in the midst of a brand makeover and has stopped building most cars. Dealers are still operating, and many have unsold cars, but the brand’s numbers will likely be off for months as it reconfigures.

Average Discount 8% and Rising

The average new car buyer negotiated an 8% discount last month. We expect that figure to rise in December. It typically does, and shoppers face a buyer’s market this month with car loans growing easier to qualify for and interest rates on the way down.

Pre-pandemic, incentives often made up 10% or more of the average new car sale. As 2025 approaches, America could be headed back toward that norm. Uncertainty dominates the market as a new presidential administration begins and threatens tariffs that could drive all new car prices up.

But, for those shopping this month, finding a good deal is possible if you head to a well-stocked dealership.